ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq)

Investors always seek diversity and stability in their investment portfolios, and Exchange-Traded Funds (ETFs) often present a viable solution to achieve this. Specifically exploring ETFs with exposure to innovative companies like Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc., which are traded on the Nasdaq, offers an insightful venture into risk management while potentially maximizing returns.

ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq): Exposure

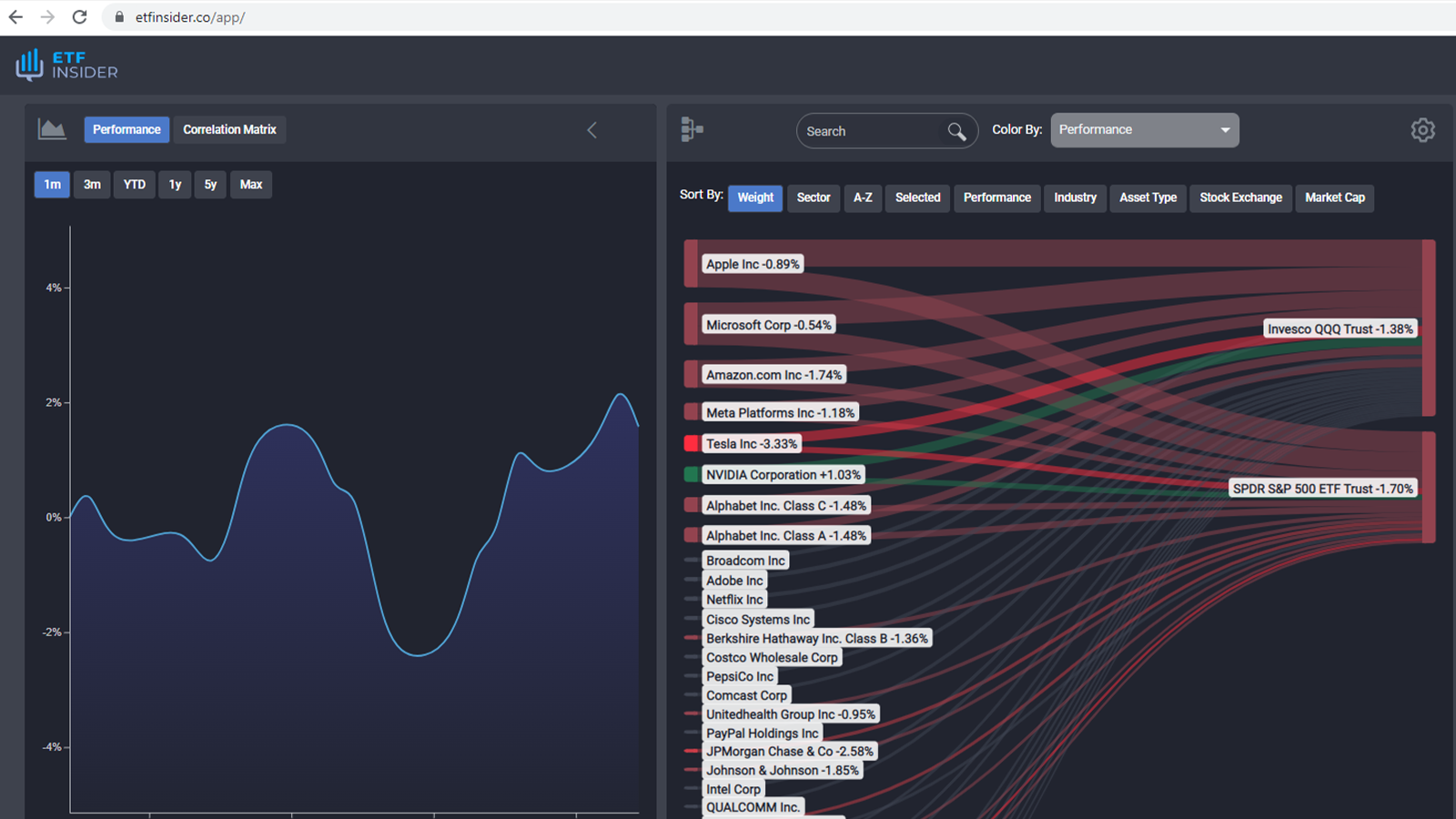

Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. are two notable entities traded on the Nasdaq, offering intriguing opportunities for investors looking for biotechnology and technology exposure, respectively. ETFs tracking the Nasdaq or specific sectors within it, such as the Invesco QQQ Trust (QQQ) or the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC), may offer investors exposure to these companies. It is pertinent to note the sector-specific risks and rewards, considering factors like technological advancements and regulatory environments for both the biotechnology and tech sectors, thereby influencing these companies' performances and, subsequently, the ETFs' yields.

ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq): Comparisons of

Comparing ETFs like the Invesco QQQ Trust (QQQ) and the iShares NASDAQ Biotechnology ETF (IBB), which may provide exposure to Vertex Pharmaceuticals and Maxim Integrated Products, reveals differences in sectoral focus and risk profiles. Whereas QQQ offers a broad spectrum of exposure to the largest non-financial companies on the Nasdaq, emphasizing technology, IBB sharpens the focus onto the biotechnology sector. Both avenues provide different diversification strategies: while the former spreads the investment across various sectors, offering a potentially balanced approach, the latter allows investors to potentially capitalize on advancements and growth within the biotechnology space specifically.

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq)

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq)

ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs with exposure to Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. provides a balanced approach to accessing the potential growth trajectories of these companies without the associated risks of direct stock ownership. ETFs inherently provide diversification, reducing dependency on the performance of a single entity. Moreover, with exposure to sectors like technology and biotechnology, investors are positioning themselves to potentially benefit from some of the most innovative and rapidly developing segments of the market, which might offer substantial returns over the long-term horizon, especially compared to the potential volatility and risk of individual stock picking.

ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq): Consideration before investing

However, considerations before investing in these ETFs should include a comprehensive understanding of the underlying sectors. While technology and biotechnology sectors have historically shown robust growth, they also come with inherent risks related to regulatory changes, competition, and technological obsolescence. Moreover, understanding the fee structures, such as expense ratios of ETFs, and how they might impact overall returns over time is critical. A thorough analysis involving historical performance, sector health, and future projections can form a strategic foundation for investment decisions involving ETFs with exposure to Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. In conclusion, while ETFs, especially those providing exposure to pioneering sectors and companies like Vertex Pharmaceuticals and Maxim Integrated Products, are lucrative, they demand a thorough understanding and strategic analysis to navigate through the nuanced pathways of investment. Adopting a balanced perspective that encapsulates both the potential rewards and inherent risks is crucial in orchestrating a robust, future-ready investment portfolio. Disclaimer: This content does not provide investment advisory services and is for informational purposes only.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Maxim Integrated Products Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.